house loan guideBest home finance loan lendersBest lenders for FHA loansBest lenders for low- and no-down-paymentBest VA property finance loan lenders

Ray was in a position to capture items in my payroll studies that were not caught by HR. Ray was also always simple to obtain a maintain of and constantly answered all of my queries immediately. TurboTax manufactured The full working experience effortless."

Audit assistance is informational only. We will likely not signify you ahead of the IRS or condition tax authority or give lawful tips. If we are not able to connect you to at least one of our tax professionals, We'll refund the applicable TurboTax federal and/or state license purchase value you paid. This assure is good for your life span of your own, individual tax return, which Intuit defines as seven several years from the date you submitted it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. supplemental terms and limitations apply. See License Agreement for facts.

in case you’re a self-used individual working a business as a sole proprietorship (which includes a aspect occupation), you don’t should file a individual tax return for the business.

TurboTax professionals are available to supply normal consumer assistance and aid using the TurboTax merchandise. companies, areas of experience, working experience levels, wait occasions, hrs of Procedure and availability vary, and so are topic to restriction and change suddenly. restrictions utilize See Terms of provider for aspects.

We’ll aid decrease the amount you owe, lower your expenses on taxes, and locate tax credits that are distinct in your business. We’re identified for getting you every tax benefit both you and your tiny business deserve.

TurboTax Desktop Products: price tag contains tax preparing and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. supplemental service fees may well apply for e-submitting state returns.

immediate use of our compact business tax gurus. Connect with an expert as normally as you need, even on nights and weekends during tax time, at no additional Charge.

For a little business that may not already amassing revenue taxes, step one is for it to register with its state taxing authority.

No one hopes to pay back penalties into the IRS for lacking deadlines, so it’s vital you satisfy yours. whilst it shouldn’t take lengthy to truly file your taxes, give yourself a week or two ahead of the tax deadlines to be sure you have all your data to be able.

TurboTax Desktop products and solutions: rate features tax preparing and printing of federal tax returns and totally free federal e-file of as many as 5 federal tax returns. extra expenses may perhaps apply for e-filing state returns.

Printing or electronically filing your return reflects your satisfaction with TurboTax on read more the web, at which era you may be needed to shell out or sign up with the product.

Employers are to blame for withholding payroll taxes and ought to comply with deposit and reporting deadlines.

specified other extensions also are accessible for Us residents dwelling abroad and military personnel stationed outdoors the U.S. and Puerto Rico (you may even get a short extension to pay for any tax owed).

Jaleel White Then & Now!

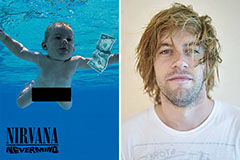

Jaleel White Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now!